days sales in inventory ratio interpretation

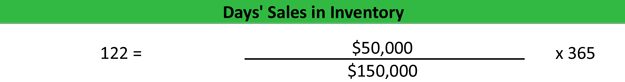

365 76 48 days. 1102 billion 145 billion 76.

Examine The Efficiency Of Inventory Management Using Financial Ratios Principles Of Accounting Volume 1 Financial Accounting

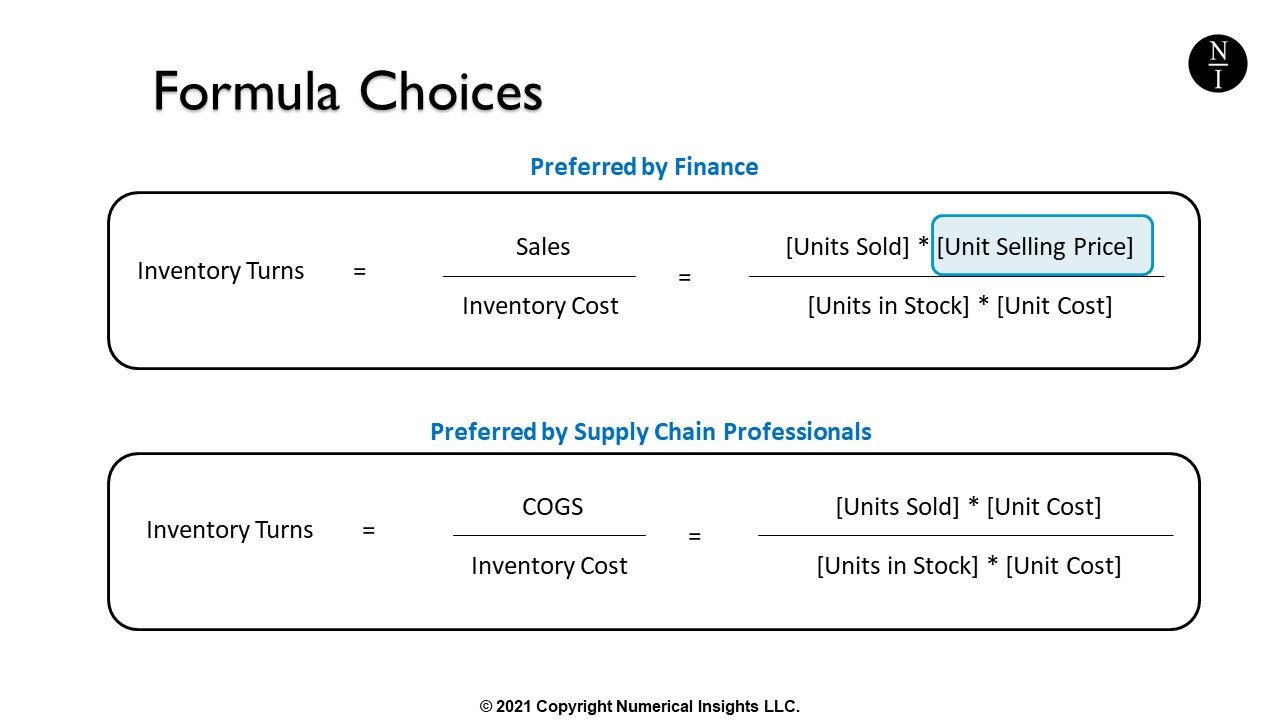

This ratio is also known as Inventory turnover days Days sales in inventory etc.

. I n v e. This inventory is then stocked in warehouses and retail shelves and eventually sold to. Accounting Our Accounting guides and resources are self-study guides to learn accounting and finance at your own pace.

Turned here means sold and replaced its inventory. The calculation of the days sales in. Days Sales in Raw Materials 365 121 6208 7 days.

Heres a sample 2019 Days Sales in Inventory calculation for each noting that Cost of Goods Sold for 2019 was 6208 million. Therefore you should view this as an average from the past. Then well divide them by two.

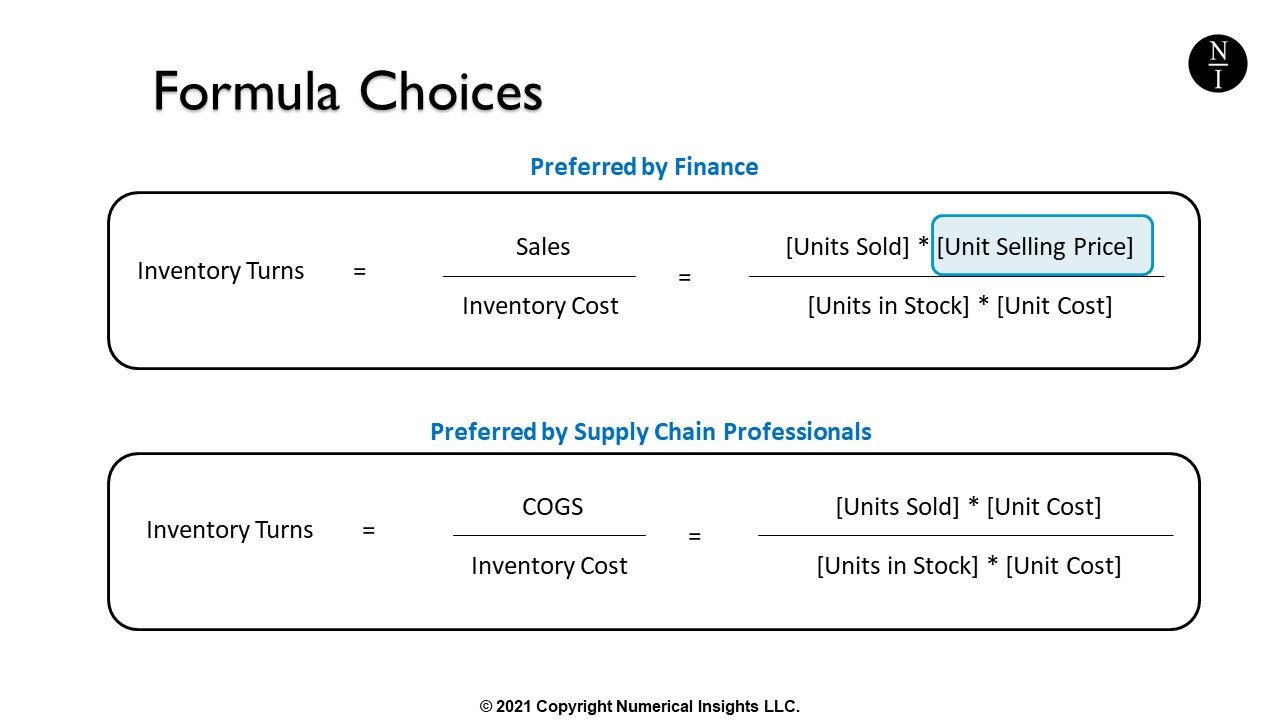

Inventory Turnover Ratio is one of the efficiency ratios and measures the number of times on average the inventory is sold and replaced during the fiscal year. DSO Accounts ReceivablesNet Credit SalesRevenue 365. For net sales well subtract the returns 500 from the gross sales 8500 Average inventory 1000.

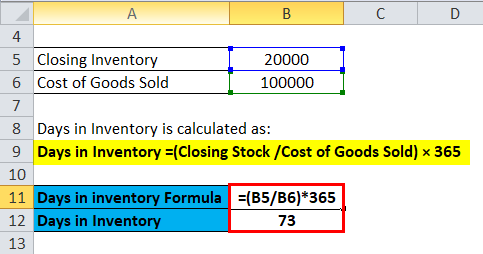

Inventory days Inventory Cost of goods sold 365 Inventory days 20000 176000 365 41 days. The number of days it takes to sell the inventory on hand may then be determined using the inventory turnover formula and the number of days in the period. Days Sales in Finished Goods 365 339 6208 20 days.

The number of days sales in inventory ratio indicates how long it takes for inventory to be sold on average which can help the firm identify instances of too much or. Days of Sales in Inventory 1446000 2506666 183 105 days. Examples or Reasons for High Inventory Days.

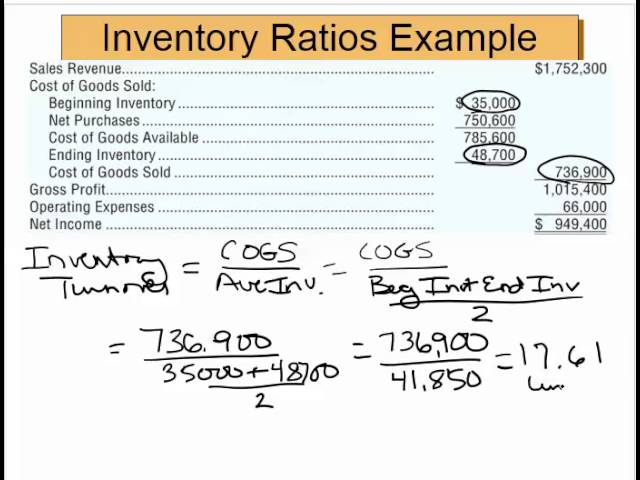

IT COGS Average Inventory 68750 55000 125. The days sales in inventory figure is intended for the use of an outside financial analyst who is using ratio analysis to estimate the performance of a company. This is consistent with the decrease in inventory during the year.

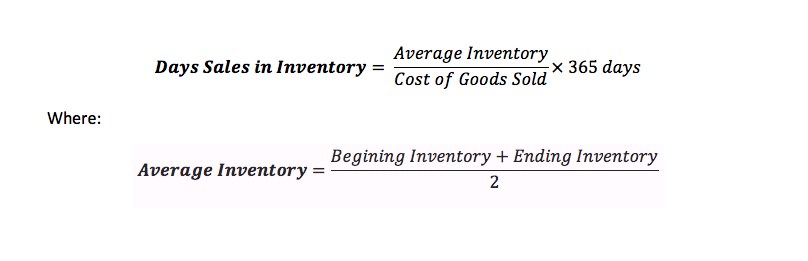

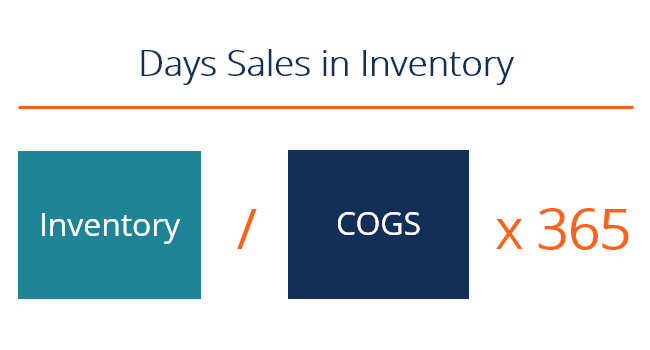

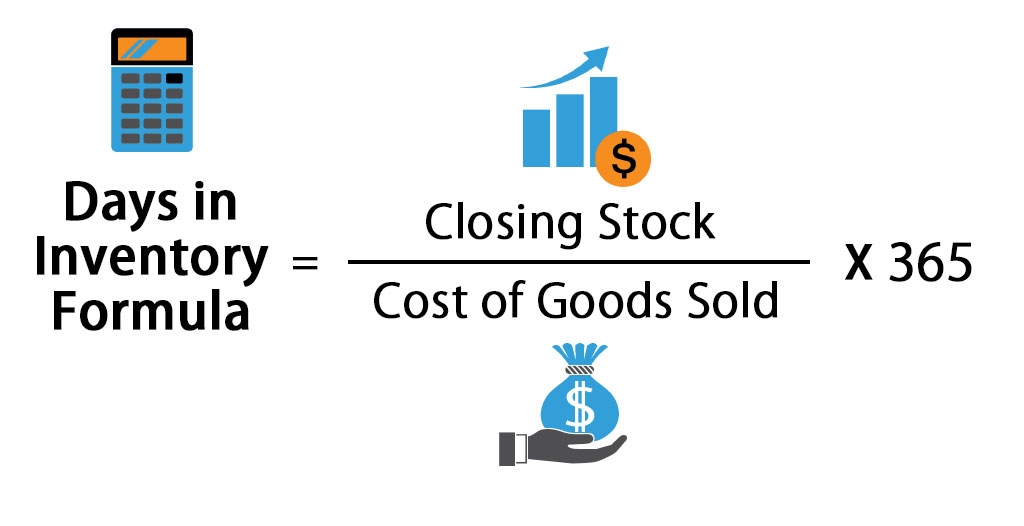

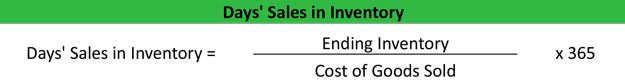

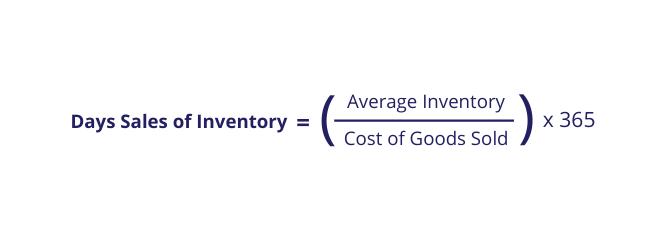

Next lets assume that a retailer increases its inventory quantities for some new. Days Sales in Inventory can be calculated by dividing the average inventory by the cost of goods sold and then multiplying the result by 365 to get DSI for a year. Product based businesses work in cycles of inventory movement.

Assume that a company maintains a constant quantity of items in inventory. The days sales of inventory value DSI is a financial measure of a companys performance that gives investors an idea of how long it. If we wanted to know home many days it takes The Home Depot to turn its inventory once we could divide the number of days in the year by the inventory turnover ratio we just calculated.

To understand any financial ratios in-depth standalone analysis will lead analysts nowhere. Keep in mind that a companys inventory will change throughout the year and its sales will fluctuate as well. Therefore a low DIO translates to an efficient business in terms of inventory management and sales performance.

The cycle starts with buying inventory at cost from a supplier. The financial ratio days sales in inventory tells you the number of days it took a company to sell its inventory during a recent year. The metric is less commonly used within a business since employees can access detailed reports that reveal exactly which inventory items are selling better or worse than average.

This in theory means that if production or supplies stopped then the business would run out of inventory after 41 days. By employing the alternative formula we can confirm that the result of this calculation is correct. If economic or competitive factors cause a sudden and significant drop in sales the inventory days or days sales in inventory will increase.

The number is then multiplied by the number of days in a. Browse hundreds of guides and resources. Day of Sales in Inventory 183 2506666 1446000 105.

As a result Company B has a smaller CDR or DPO ratio. A high days inventory outstanding indicates that a company is not able to quickly turn its inventory into sales. Calculating inventory turnover can help.

For example if the turnover ratio is 2 it means the company has sold its inventory and bought new one and sold it again within this period ie sold. The financial ratio days sales in inventory DSI tells you the number of days it took a company to turn its inventory also known as inventory turnover. Home Depot turns over its inventory about 76 times each year.

Inventory Turnover Ratio formula is. In order to do so the days sales in inventory metric was calculated by using the information given above. The DSI value is calculated by dividing the inventory balance including work-in-progress by the amount of cost of goods sold.

This ratio would also include goods that are in progress of being sold. Days Inventory Outstanding is a financial ratio that indicates the average number of days it takes a company to sell its inventory. Suppose there is a company whose days inventory outstanding DIO is 437 days and days sales outstanding DSO as 944 days.

Hence a particular ratio has to be analyzed for historical periods. Days Sales Of Inventory - DSI. A low days inventory outstanding indicates that a company is able to more quickly turn its inventory into sales.

Inventory ratio analysis tools help management to identify inefficient management practices and pinpoint troublesome scenarios within their inventory operations processes. The days sales in inventory ratio also known as days stock outstanding or days in stock measures the amount of times it is going to take a business to market all its stock. Net sales 8000.

Now that we have everything we can calculate our ratio using the formula. It is done by showing the number of data points that fall within a specified range of values which is knowns as bins. In practice it is unlikely that demand would.

The inventory days ratio or days in inventory ratio shows the average number of days sales a business is holding in its inventory. Inventory Turnover Ratio measures companys efficiency in turning its inventory into sales. To put it differently the times sales in inventory ratio reveals the number of days per firms recent asset of stock will continue.

Its purpose is to measure the liquidity of the inventory. The business on average is holding 41 days of sales in its inventory. Inventory turnover ratio is a financial ratio that indicates how many times a companys inventory has been sold and replaced in a given period.

Days Sales in Work in Process 365 414 6208 24 days. This means that the company has turned its inventory 125 times in a year. Keep in mind that a companys inventory will change throughout the year and its sales will fluctuate as well.

As with most financial ratios differences exist among industries. Days Inventory outstanding meaning. Hence the Trend Analysis has to be performed.

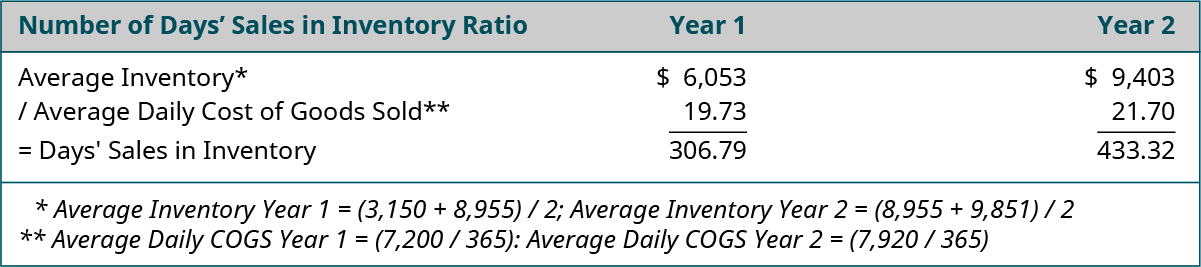

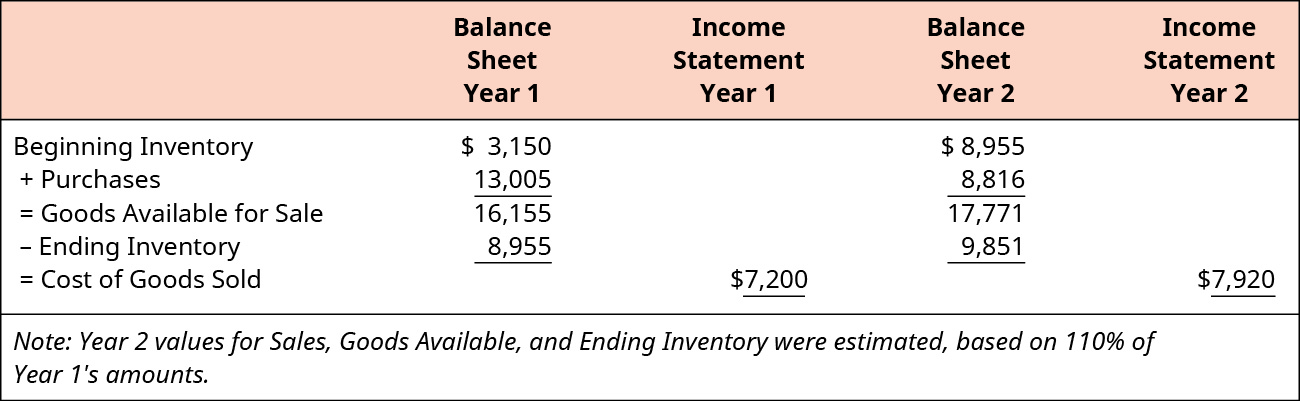

As shown previously the number of days sales in inventory increased from 498 to 552 during Year 2 and thus Best Buys inventory management did not improve.

Inventory Days Formula Meaning Example And Interpretation

Days Sales In Inventory Definition Formula Calculated Example Analysis

Days In Inventory Formula Calculator Excel Template

Days Inventory Outstanding Dio Formula And Excel Calculator

Inventory Turnover Ratio Days Sales In Inventory The Two Restaurant Inventory Metrics That Will Help You Squash Food Cost Maximize Profits Apicbase

Days Sales In Inventory Dsi Overview How To Calculate Importance

Inventory Days Double Entry Bookkeeping

Days Sales Outstanding Formula Meaning Example And Interpretation

Days In Inventory Formula Calculator Excel Template

Formula To Calculate Inventory Turns Inventory Turnover Rate

Days Sales In Inventory Dsi Formula And Example Calculation

Inventory Days Formula Meaning Example And Interpretation

Ineventory Turnover And Days Sales In Inventory Ratios Youtube

Days Sales In Inventory Ratio Analysis Formula Example

Inventory Days Formula How To Calculate Days Inventory Outstanding

Days Sales Outstanding Dso Formula And Excel Calculator

Days Sales In Inventory Ratio Analysis Formula Example

Inventory Turnover Ratio Formula And Tips For Improvement

Examine The Efficiency Of Inventory Management Using Financial Ratios Principles Of Accounting Volume 1 Financial Accounting