april 2016 service tax rate

The Said change will be effective from 1st June 2016. While presenting the Budget 2015 the FM had increased the Service Tax Rate from 1236 to 14.

Service Tax Interest Rates on delayed payment of Service Tax in case of assessees whose value of taxable services in the preceding yearyears covered by the notice is less than Rs60 Lakh.

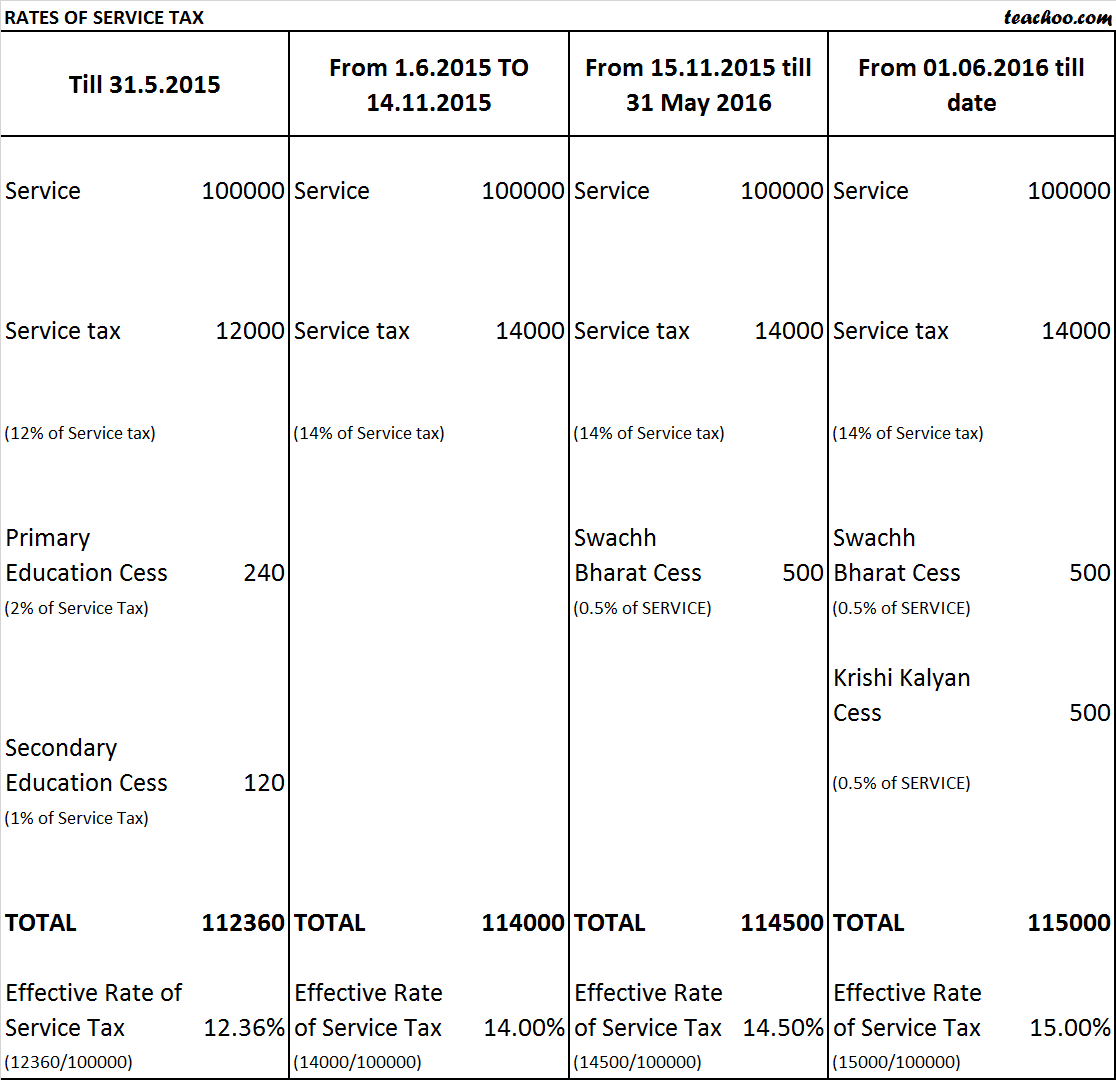

. Honble Finance Minister Sh. Important Changes in Service Tax in Budget 2015-2016. The new effective service tax could henceforth be 15.

The increase in Service Tax affected some services in the following way. 42 1430 435 14530 45 1530 Effective from 01042016 a uniform abatement at the rate of 70 is prescribed for services of construction of complex building civil structure or a part thereof subject to fulfillment of the existing conditions. Service Tax Rate.

Service Tax Late Payment Interest Rate from 14052016 Interest payable for delayed payment of Service Tax is 15. 132016-ST dated 1-3-2016 effective from 14th May 2016. Arun Jaitley tables the Union Budget 2016 on 29 Feb-2016 citing that 05 of Krishi Kalyan Cess to be levied on all the services making the effective service tax rate 15 ie.

The calculation of the amount that can be levied is done as a percentage of the charges paid or received for the receipt or provision of services. From 142016 service tax is leviable on 30 on amount charged for service of transport of passengers by rail without availability of cenvat credit of inputs and capital goods. 16 rows Rate of Service tax would eventually increases to 15 wef.

The import customs duty rate on Brussels sprouts will be decreased from 13 to 5 from 22 April 2016 to 31 May 2019 inclusive. The 15 includes 05 Krishi Kalyan Cess and 05 Swach Bharat Cess. Abatement will continue with the same level with cenvat credit of input services for the said service.

Service Tax collected but not deposited to the exchequer Government 24. Penal Rate in case of tax collected but not deposited to exchequer. If a new levy is introduced like Krishi Kalyan Cess or a service taxed for first time then Rule 5 is to be referred.

The estimated 2 million generated by the tax increase will fund additional public safety measures in the French Quarter such as a full-time state trooper presence. Simple Interest Rate 12 Proviso to Section 75 and NOTIFICATION NO132016-ST DATED 1-3-2016. How the increase in Service Tax affected Various Services.

For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be 12. You may also like to read Chapter V of Finance Act 1994. From the 1st of June 2016 service tax is levied at 15 of the value of taxable services under Section 66 of the Service Tax Act.

In above chart replace 15 with 145 in above chart to calculate old rate. The Finance Bill 2015 proposes an increase in rate of Service Tax from 1236 to 14. The government notification extract also is being updated in pdf format once after release from the authorities.

For the scenario till 31032016. This new rate of Service Tax 14 was applicable from 1st June 2015. INR 1000 INR 100 per day from 31st day subject to a maximum amount of Rs 20000.

20 of 2015 the Central Government hereby appoints the 1st day of April 2016 as the date on which the provisions of sub-section 1 of section 109 of the said Act shall come into effect. The rate of Service Tax was increased from 1236 to an all inclusive flat 14 which included Subsuming Education Cess and Secondary Higher Secondary Education Cess. The service tax rate changes for Promotion of Brand of Goods Services etc under Indian Budget 2017-18 is being updated below soon after announcement of Budget on 1 st February 2017.

From April 2016 the new Personal Savings Allowance means that basic rate taxpayers will not have to pay tax on the first 1000 of savings income they receive and higher rate taxpayers will. Changes applicable from 1st April 2016. Provided also that where the gross amount of service tax payable is nil the Central Excise officer may on being satisfied that there is sufficient reason for not filing the return reduce or waive the penalty.

14 Swachh Bharat Cess 05 Krishi Kalyan Cess 05 the same will be applicable wef01-06-2016 after the enactment of Finance Bill. After levy of KKC. Some 9 million tourists visit the French Quarter annually.

The service tax rate may get changed by Budget 2016 from 145 to 16. The import customs duty rate on several types of almond dates and grapes will be decreased from 5 to 0 from 22 April 2016 to 31 May 2019 inclusive. Service Tax Basic Rate -14 Swachh Bharat Cess 05 wef.

60 Lakhs then the rate of interest on late payment will be 12. New tax rates which take effect on January 1 2016 will be 925 for retail and close to 10 for restaurants. SERVICE TAX RATE CHART FOR FY 2016-17 and AY 2017-2018 upto 1st June 2016 Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05.

In exercise of the powers conferred by section 109 of the Finance Act 2015 No. At present service tax is leviable on 30 of the value of service of transport of goods by vessel without Cenvat credit on inputs input services and capital goods. If in case the value of taxable services of preceding year does not exceeds Rs.

Budget 2016 has proposed to impose a Cess called the Krishi Kalyan Cess 05 on all taxable services. Thus abatement of 70 is presently available in respect of the said service. However if assessee has collected service tax but did not deposit it with Government interest rate will be 24 Notification No.

For detail article about service tax changes applicable from 1416 read here. Service tax rate 145 is applicable for period during 142016 to 3152016. Refer point of taxation article for further clarification.

The Education Cess and Secondary and Higher Education Cess shall be subsumed in the revised rate of Service Tax. 8 rows April 2016-Sep 2016 April-May 145 July-Sep-15 Oct 2016-March 2017 Oct-March 15. Cenvat credit of input services are now available.

Makmn Co In Indirect Tax Financial Management Income Tax

Marginal Tax Rate Formula Definition Investinganswers

Kanakkupillai A Virtual Accountant Accounting Services Limited Liability Partnership Accounting

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Tax Deducted At Source Chart Taxact

Tds Due Date List April 2020 Accounting Software Due Date Dating

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

What Is The Rate Of Service Tax For 2015 16 And 2016 17

Pin On Inventory Management Software India

Pin By Rajesh Doye On Gst India Goods And Services Tax Goods And Service Tax Goods And Services Indirect Tax

Key Issues Tax Expenditures Types Of Taxes Infographic Tax

Goods And Services Tax Goods And Service Tax Goods And Services Tax

Direct Indirect Taxes Data Indirect Tax Directions Tax

Taxtips Ca Business 2020 Corporate Income Tax Rates

October Is Tax Month Now Social Media By Rgsc Chartered Accountants Infographic Http Bit Ly 2mvuxof Infographic Infographic Marketing Social Media

Pin By Lisapetbulous On Electric Scooter Business Singapore

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Long Term Capital Gain Tax Rate For 2018 19 Capital Gain Capital Gains Tax What Is Capital